At Altruic Advisors, we use Bill.com to manage accounts payable for the nonprofit organizations we serve. Our CFO Solutions clients upload their bills to a secure document portal, where our accountants retrieve the bills and process them for payment. The client will approve the bill online (or through Bill.com’s mobile app), then our accountants release payment based on due dates, cash flow, and other accounting considerations. Sounds easy, right? That’s because it is!

Here’s how to approve bills in Bill.com:

Log in at: https://www.bill.com/

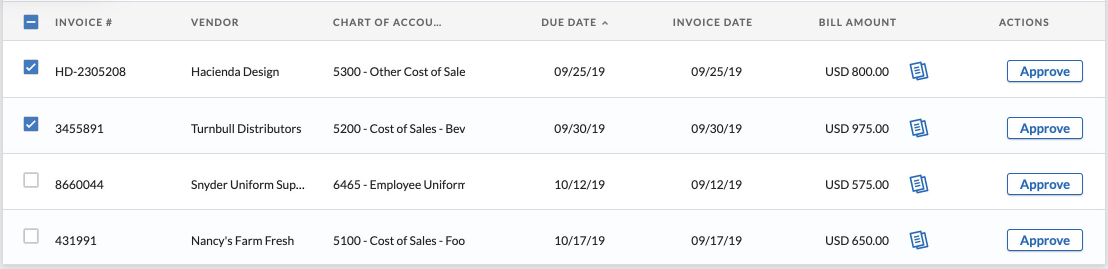

Review the bills that have been assigned to you for approval. Click through to see a full PDF image of the original invoice, as well as additional details like accounting codes, classes, and memos. You can use the built-in “Notes” feature to ask questions, request edits, or communicate with your accountants.

Select the bills you want to approve. By approving a bill, you are confirming that it is valid, correct, and okay to pay. You can also choose to deny a bill if it is incorrect or assigned to the wrong approver.

Click “Approve.” Your approval will be timestamped, creating an audit trail and a virtual signature for every bill. This trail cannot be edited or deleted; creating a safe and secure bill-pay workflow.

An example of how bills will look when they are ready for your approval in Bill.com

After you have approved your bills, our accountants will schedule and release payment to your vendors. Payments are processed through a Bill.com clearing account, which keeps your banking information private. Vendors can be paid electronically by ACH, by check, by international wire transfer, or by Vendor Direct (a single-use virtual card payment). Your bank account will be debited by Bill.com on the process date, which makes it easier to manage cash flow and helps prevent overdrafting your bank account. Many nonprofit organizations operate with tight budgets or intermittent revenue, so Bill.com really helps to schedule your expenses and plan ahead.

ACH payments are the fastest, easiest way to pay your bills. Our accountants send invitations to your vendors, asking them to accept ACH payments through Bill.com. If the vendor opts in, we can pay them electronically. If not, no problem - Bill.com will mail a check instead. If the check is unable to be delivered, or is not cashed by the vendor within 90 days, our accountants will be notified by Bill.com. We can easily cancel checks or reissue checks when necessary. International wire transfers are also available if you pay vendors outside of the United States.

All Bill.com transactions are automatically synced into your accounting system and posted to your general ledger. This creates a clear accounting trail for every expense, and helps reduce data entry and save time. It’s also possible to provide others with read-only access to your Bill.com account, which makes your annual audit or internal financial reviews so much easier (and faster) to complete. It’s all right there in black and white – the invoice, the accounting, the approval, and the payment.

If your nonprofit organization could benefit from the Bill.com accounts payable system or other elements of our CFO Solutions services, contact Altruic Advisors today.