Nonprofit Audits & Reviews

Altruic Advisors provides independent audits and reviews for nonprofit organizations. Nonprofits that receive state or federal funding are often required to undergo an annual audit. Audited financial statements are also a frequent stipulation of grant funding. Even when it’s not required, an independent audit is a valuable way to demonstrate financial transparency and accountability to your donors.

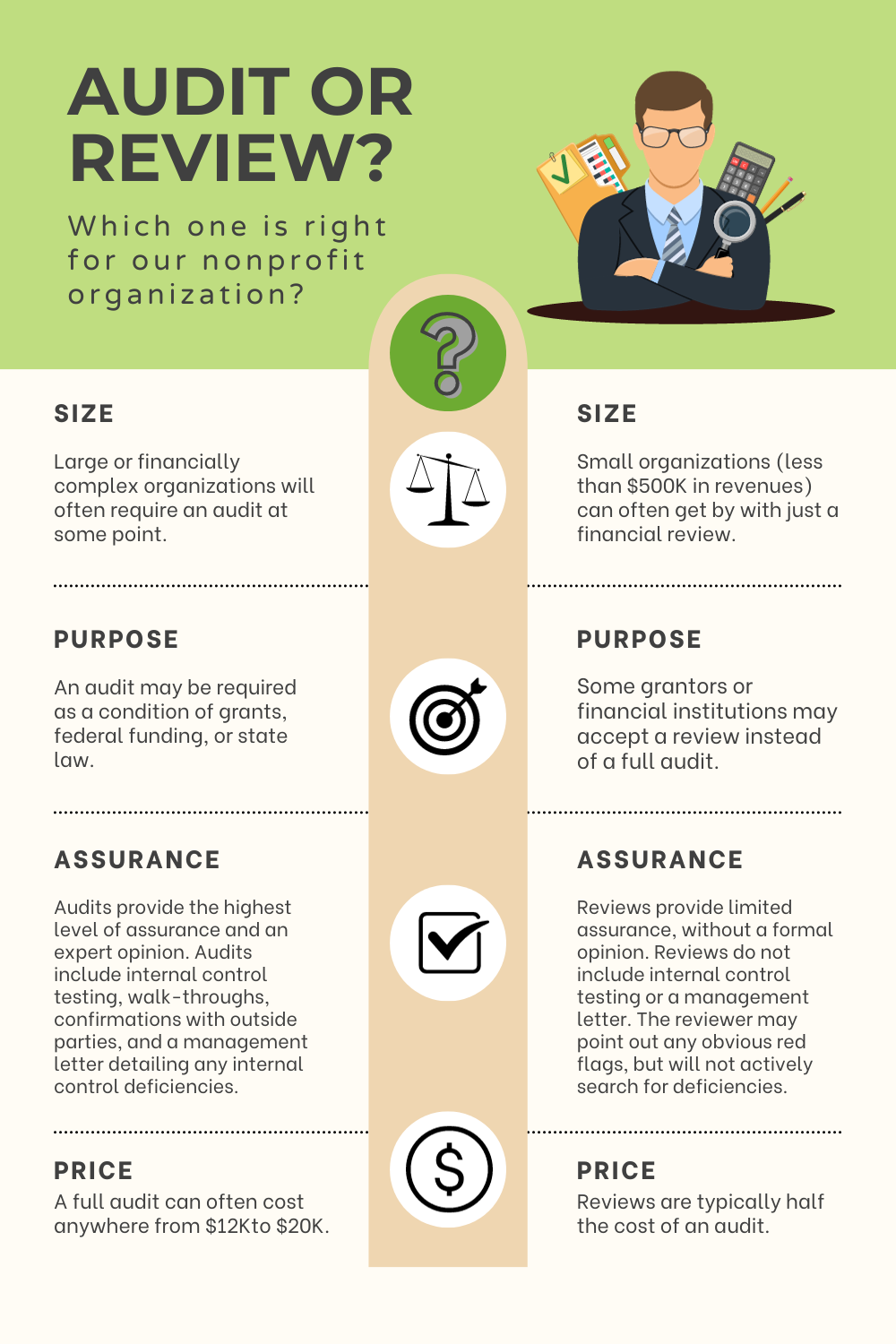

A full audit isn’t always necessary. Many nonprofits can satisfy their requirements with a less-expensive financial statement review. Some key differences include:

organization size

Large or financially complex organizations will often need an audit at some point.

For small nonprofits with less than $500,000 in annual revenues, a review may be sufficient.

Purpose

An audit may be necessary to comply with federal or state regulations, funding conditions, or grant requirements.

In some cases, your grantors or financial institutions might be willing to accept a review instead - it doesn’t hurt to ask!

Assurance

Audits provide the highest level of assurance that your financial statements are accurate and free of any misrepresentation. Audits include internal control testing, walk-throughs, confirmations with outside parties, and other procedures that allow us to offer an expert opinion on the state of your finances.

Reviews provide some limited assurance, but not as much as audits. Reviews do not include any internal control testing. We will point out any obvious red flags that we stumble across, but we’re not actively looking for errors or deficiencies.

Price

A full audit can often cost anywhere from $12,000 to $25,000, depending on the organization’s complexity and preparedness. You can keep costs down by providing prompt responses to our inquiries and making sure that all of your financial documentation - bills, bank statements, receipts, payroll records, lease agreements - are organized and easily accessible to our auditors.

Reviews typically cost half as much as a full audit. Since reviews do not include internal control testing or other audit procedures, they take much less time to complete. Those time savings are reflected in the price of a review.

A compilation can also be helpful for nonprofits who require neither an audit or review. Compilations are a cost-effective way to generate professional financial statements that can be easily reviewed by third parties such as grantors or lenders. In a compilation, we will prepare your organization’s financial statements; however, we will not verify the accuracy of those statements or provide any assurance or opinion about your financial position.

When conducted by traditional accounting firms, nonprofit audits can quickly become frustrating and expensive. But with decades of experience in auditing not-for-profit organizations, we’re able to streamline your audit experience and keep costs low.