Form 990 Preparation for Nonprofits

The Form 990 is an annual IRS informational return for tax-exempt organizations. Unlike private income tax returns, your 990 is considered public information. This allows donors to freely evaluate your organization’s finances, mission, operations, and activities.

The cost of preparing a Form 990 can vary depending on your organization’s annual income, assets, and other details. To estimate your total costs, answer a few simple questions using our Form 990 Quote Calculator.

Like an audit or review, the Form 990 is an official financial representation of your organization, demonstrating transparency and accountability to donors. A well-prepared Form 990 can make all the difference in grant approvals, major donations, and nonprofit ratings from sites likes Charity Navigator and GuideStar.

Which Form 990 To File

To determine which 990 your nonprofit organization should file, you need to know two things:

Gross Receipts - The total amount your organization has received from all sources during your annual accounting period, without subtracting any costs or expenses.

Total Assets - The amount reported by your organization on your balance sheet (Statement of Financial Position) as of the end of the year, without any reduction for liabilities.

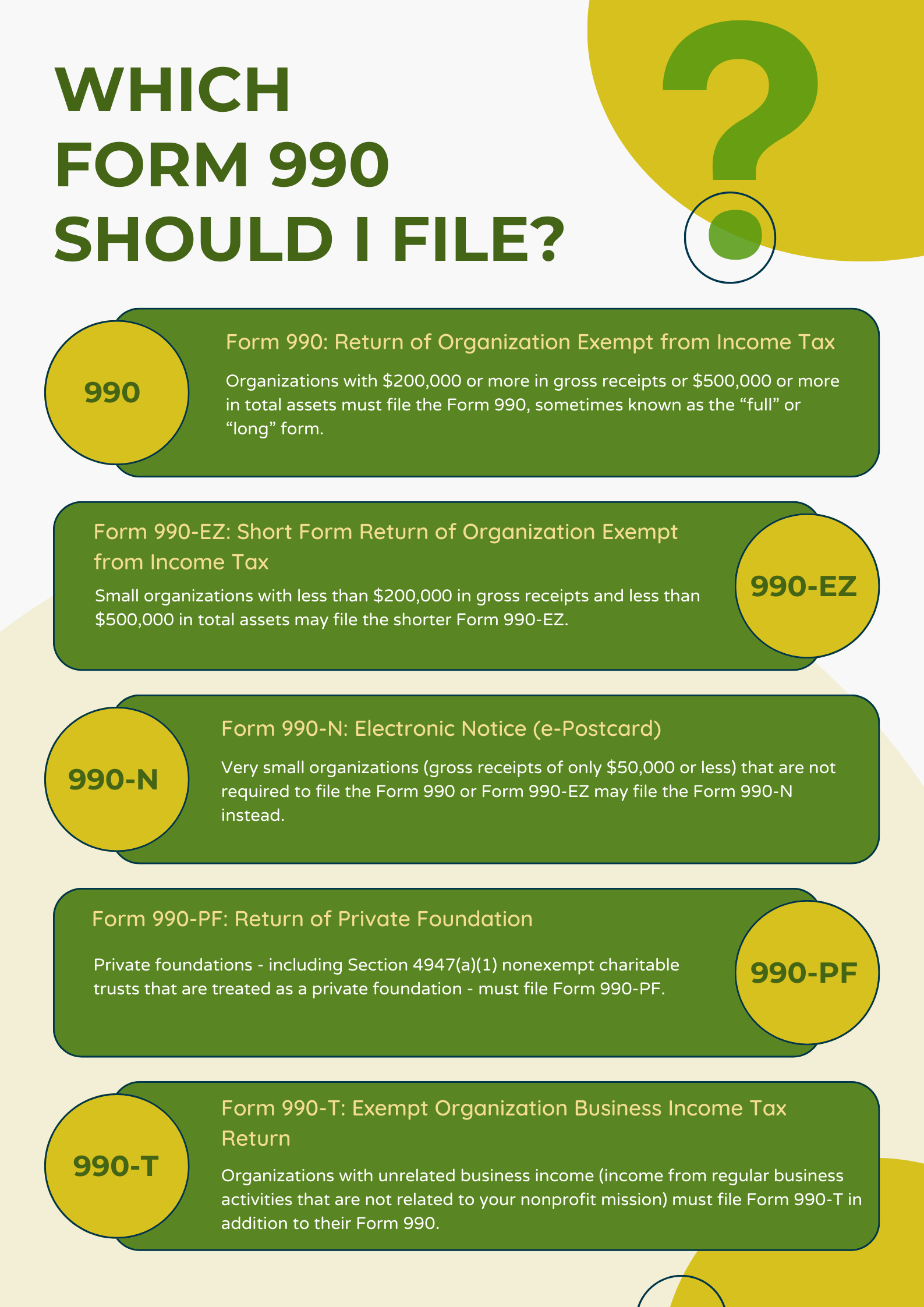

There are several different types of Form 990:

Form 990: Return of Organization Exempt from Income Tax - Organizations with $200,000 or more in gross receipts or $500,000 or more in total assets.

Form 990-EZ: Short Form Return of Organization Exempt from Income Tax - Small organizations with less than $200,000 in gross receipts and less than $500,000 in total assets.

Form 990-N: Electronic Notice (e-Postcard) for Tax-Exempt Organizations Not Required to File Form 990 or Form 990-EZ - Very small organizations with gross receipts of only $50,000 or less.

Form 990-PF: Return of Private Foundation - Private foundations (or Section 4947(a)(1) nonexempt charitable trusts that are treated as a private foundation) of any size.

Form 990-T: Exempt Organization Business Income Tax Return - Organizations with unrelated business income. This includes income from regular business activities that are not related to your nonprofit mission, like private event rentals or merchandise sales.

Form 990 Filing Deadlines and Extensions

Your annual Form 990 is due on the 15th day of the 5th month after your fiscal year ends:

Fiscal Year Ending December 31 - Due May 15

Fiscal Year Ending November 30 - Due April 15

Fiscal Year Ending October 31 - Due March 15

Fiscal Year Ending September 30 - Due February 15

Fiscal Year Ending August 31 - Due January 15

Fiscal Year Ending July 31 - Due December 15

Fiscal Year Ending June 30 - Due November 15

Fiscal Year Ending May 31 - Due October 15

Fiscal Year Ending April 30 - Due September 15

Fiscal Year Ending March 31 - Due August 15

Fiscal Year Ending February 28 - Due July 15

Fiscal Year Ending January 31 - Due June 15

You may request a 6-month extension from the IRS if you cannot file your Form 990 by the due date.