You hired an accountant to help your nonprofit organization succeed. But did you know there are ways that you can help your accountant succeed too? It all starts with organization. Any accountant will tell you that an organized client makes their job faster and easier, which can help keep your costs down. Here are five things you can do to get organized and keep your accountant happy:

Consolidate Information

The first step in organization is to consolidate how you are sending information to your accountant. If your accountant handles your accounts payable, try consolidating your invoices and sending them all at once on a weekly basis instead of one-by-one. You can provide deposit slips and expense receipts to your accountant once a week as well, or monthly depending on the volume. Scheduling a dedicated day to process documents of a similar type makes it harder for things to slip through the cracks. It may also be helpful to set up a shared folder or document portal where you can upload files, instead of sending them over email.

Use Control Sheets

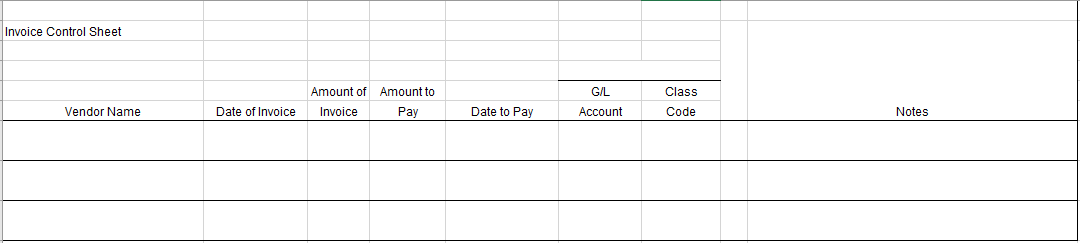

An example of a simple control sheet for accounts payable.

A control sheet is a standardized form where you can enter information related to your payables and receivables, such as due dates, memos, general ledger accounts, classes, etc. For accounts payable, a control sheet provides a clear way to tell your accountant which invoices need to be paid and how to code or classify the expenses. It also makes it easier to confirm that all bills were processed according to your wishes and that all the related documentation was received and filed. For accounts receivable, you may have incoming deposits, wires, ACH payments, and other revenue that all needs to be categorized correctly. Recording all of your deposits on a control sheet will ensure they are all accounted for and recorded properly within your accounting system. This will also make it easier for your accountant to reconcile your bank statements at the end of the month. Control sheets keep everything organized and ensure that nothing gets lost in translation between you and your accountant.

Keep Your Coding Consistent

When it comes to coding transactions within your general ledger, accuracy and consistency is very important. In some cases, you may find that an expense could potentially fit under one of several different accounts. In these situations, always be sure to pick one account and stick to it. For example, if you receive a recurring monthly bill for website hosting, you don’t want to code that expense to Telecommunications in one month and Website Expenses the next month. Consistency is the key. It may help to assign one individual to code the same expenses or revenue transactions every month. When transactions are miscoded, it can cause problems in your financial reporting and take extra time to verify the correct general ledger account for miscoded items.

Digitize and Organize Receipts

Providing your accountant with piles of crumpled credit card receipts will only cause confusion and delays, especially if there are multiple credit card users at your organization. It’s much more efficient for each cardholder to organize and digitize their own receipts, then forward them to your accountant all at once. A good way to keep credit card receipts organized is to have each cardholder scan their monthly receipts into a folder and compress it into a zip file, which can then be sent to your accountant. To make sure the credit card expenses are coded correctly, you can export your monthly credit card statement into an Excel file. Within that Excel file, you can clearly code each expense by adding a column for the GL account and class. This will help your accountant reconcile your credit card accounts more quickly.

Set Recurring Reminders

It’s no surprise that many nonprofit professionals have very busy schedules. When you have so many other things on your mind, it can be easy to forget about accounting tasks. But without timely information from you, your accountant cannot do their job. For many organizations, it’s important to have your financial statements prepared before a certain date, such as a quarterly board meeting. But if your accountant is still waiting on a document or report from your organization, there is no way they will be able to finish preparing those financial statements on time. Any delays on your end will inevitably lead to delays on your accountant’s end as well. Help your accountant succeed by scheduling weekly or monthly calendar reminders on your calendar for anything that you need to provide.

These simple steps will help maintain a clean, organized accounting environment. By making your accountant’s job easier, you can help reduce costs, eliminate inefficiencies, and avoid future headaches.