Whether you’re launching a brand-new nonprofit or just trying to get more organized, it can be hard to know where to begin. When it comes to accounting, the first step is to create your chart of accounts. The chart of accounts (or COA) is a numbered list that categorizes your financial activity into different accounts and subaccounts. Every nonprofit organization has a unique COA that depends on your specific programs, revenue sources, and activities. But in general, your COA should follow some standard guidelines and numbering conventions.

A chart of accounts is commonly numbered as follows:

Statement of Financial Position

Assets: 1000-1999

Liabilities: 2000-2999

Equity/Net Assets: 3000-3999

Statement of Activities

Revenue: 4000-4999

Expenses: 5000+

This means that any assets owned by your nonprofit (like bank accounts, investments, property, and equipment) should be numbered in the 1000 range. Liabilities (like loans, mortgages, and accounts payable) should be in the 2000 range. Your organization’s restricted and unrestricted net assets should be numbered in the 3000 range. Revenue from donations or sales should be in the 4000 range, and expenses for programs, utilities, salaries, and everything else should be numbered as 5000 or above.

When you’re numbering your accounts, follow these three rules:

Keep things simple. You don’t need separate accounts for paper, pens, envelopes, and staples; you can just have one account for office supplies. If you need more detailed layers of organization, you can add class codes.

Group similar accounts together. It’s easier to read and understand your financial reports when your accounts are listed in a logical order.

Leave room for growth. You can’t group similar accounts together if all the numbers are already taken! Think about how your needs might change in the future, and leave gaps between your account numbers so you can add new accounts later.

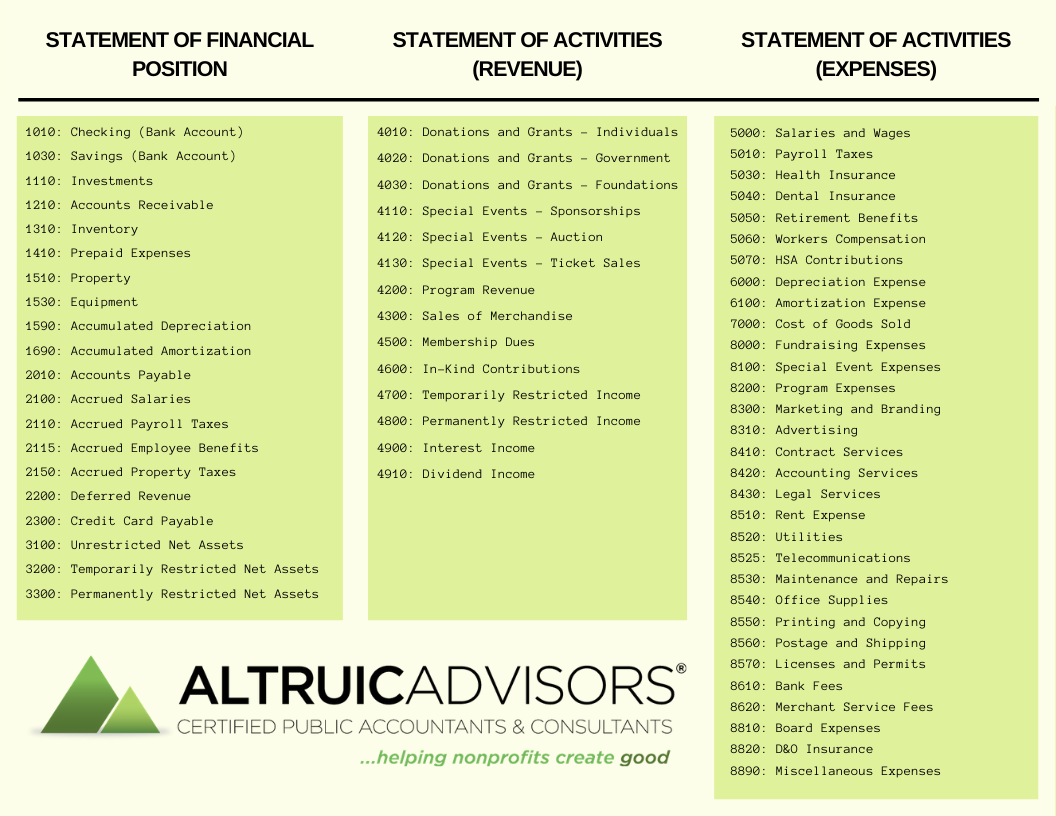

Below is a sample chart of accounts for nonprofit organizations. Remember, this is only an example – your nonprofit might have different types of revenue and expenses, or own different assets that will alter your chart of accounts. Use this as a guideline, and think carefully before you finalize your account numbers. Build a solid framework that you can easily add to in the years to come!

1010: Checking (Bank Account)

1030: Savings (Bank Account)

1110: Investments

1210: Accounts Receivable

1310: Inventory

1410: Prepaid Expenses

1510: Property

1530: Equipment

1590: Accumulated Depreciation

1690: Accumulated Amortization

2010: Accounts Payable

2100: Accrued Salaries

2110: Accrued Payroll Taxes

2115: Accrued Employee Benefits

2150: Accrued Property Taxes

2200: Deferred Revenue

2300: Credit Card Payable

3100: Unrestricted Net Assets

3200: Temporarily Restricted Net Assets

3300: Permanently Restricted Net Assets

4010: Donations and Grants – Individuals

4020: Donations and Grants – Government

4030: Donations and Grants – Foundations

4110: Special Events – Sponsorships

4120: Special Events – Auction

4130: Special Events – Ticket Sales

4200: Program Revenue

4300: Sales of Merchandise

4500: Membership Dues

4600: In-Kind Contributions

4700: Temporarily Restricted Income

4800: Permanently Restricted Income

4900: Interest Income

4910: Dividend Income

5000: Salaries and Wages

5010: Payroll Taxes

5030: Health Insurance

5040: Dental Insurance

5050: Retirement Benefits

5060: Workers Compensation

5070: HSA Contributions

6000: Depreciation Expense

6100: Amortization Expense

7000: Cost of Goods Sold

8000: Fundraising Expenses

8100: Special Event Expenses

8200: Program Expenses

8300: Marketing and Branding

8310: Advertising

8410: Contract Services

8420: Accounting Services

8430: Legal Services

8510: Rent Expense

8520: Utilities

8525: Telecommunications

8530: Maintenance and Repairs

8540: Office Supplies

8550: Printing and Copying

8560: Postage and Shipping

8570: Licenses and Permits

8610: Bank Fees

8620: Merchant Service Fees

8810: Board Expenses

8820: D&O Insurance

8890: Miscellaneous Expenses