The IRS Form 990 is an annual informational return for tax-exempt organizations. With a few exceptions (such as churches), most tax-exempt nonprofits are required to submit this form to the IRS once a year. This form contains information about your organization’s finances, mission, operations, and activities.

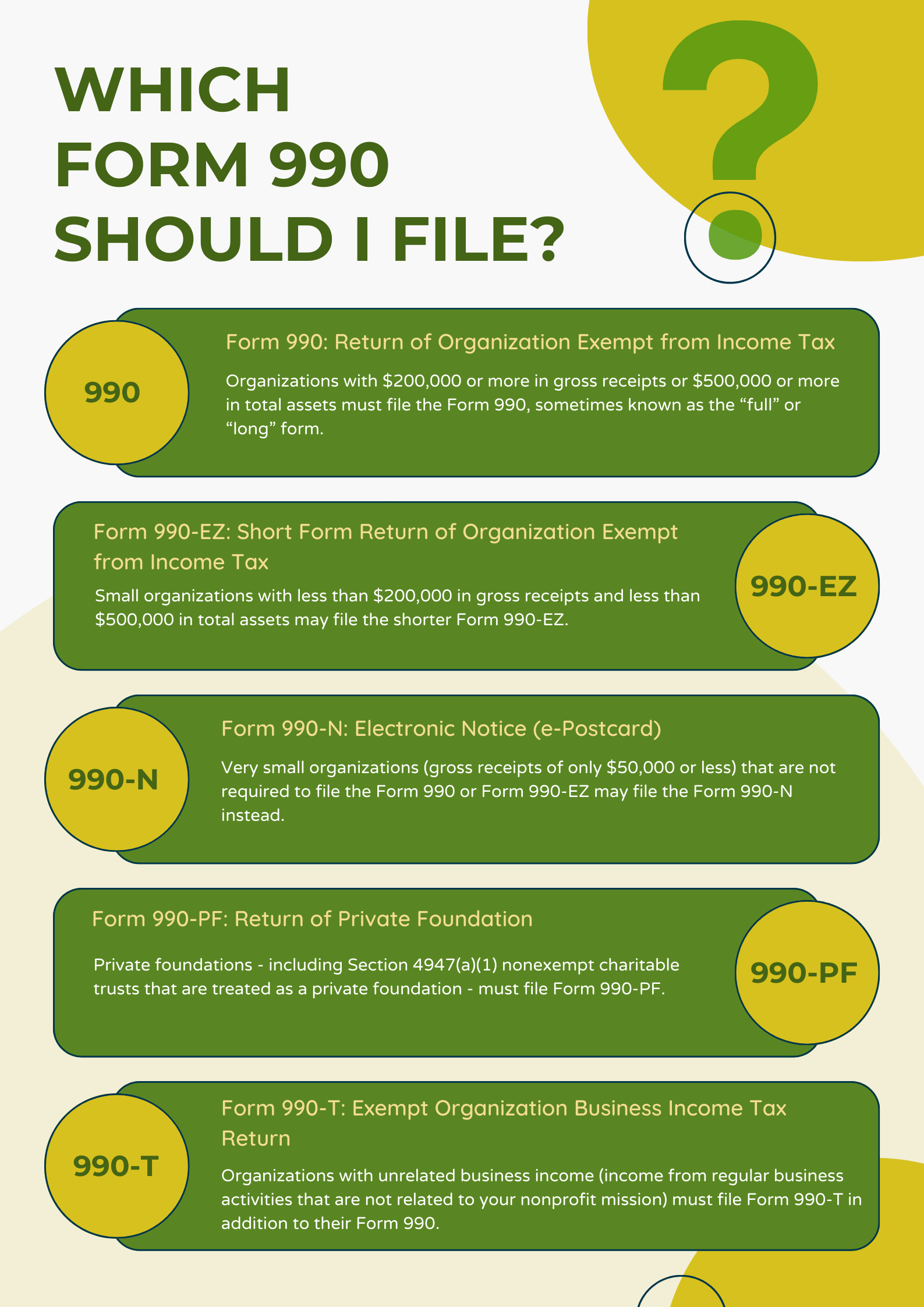

There are several different versions of the 990.

Form 990

Return of Organization Exempt from Income Tax

Also known as the “long” 990, this is the full 12-page version of the form. It includes many in-depth questions and related schedules about your organization’s financial environment, governance, management, and other operational information.

Form 990-EZ

Short Form Return of Organization Exempt from Income Tax

This is the “short” 4-page version of the 990. It has fewer questions, but still requires detailed information regarding your finances, programs, and stakeholders.

Form 990-N

Electronic Notice (e-Postcard)

This is the simplest version of the 990. It is often known as the “postcard” 990, because all of the required information could easily fit on a postcard! This includes only the most basic information about your organization.

Form 990-PF

Return of Private Foundation

This is a more complex version of the full 990, but it only applies to private foundations. This form includes additional questions about a foundation’s private assets and other financial activities.

Form 990-T

Exempt Organization Business Income Tax Return

This form is only filed if your nonprofit has unrelated business income; in other words, income from regular business activities that are not related to your nonprofit mission. This might include private event rentals or merchandise sales. If a 990-T is required, you will file it alongside your regular Form 990.

Now that you understand the differences between the different types of 990 forms, how do you know which one to file? To determine which 990 to file, you need to know two things:

Gross Receipts

This is the total amount of income your organization received from all sources during your fiscal year, without subtracting any expenses.

Total Assets

This is the total amount reported on your balance sheet (the Statement of Financial Position) at the end of your fiscal year, without subtracting any debts or liabilities.

If your gross receipts are $200,000 or more or your total assets are $500,000 or more: You need to file the full Form 990.

If your gross receipts are less than $200,000 and your total assets are less than $500,000: You can file the Form 990-EZ.

If your gross receipts are less than $50,000: You can file the Form 990-N.

If your organization is a private foundation: You need to file the Form 990-PF.

If you earn income that is unrelated to your exempt purpose: You need to file the Form 990-T.

Still have questions? Try our Form 990 Quote Calculator to generate a custom quote for 990 preparation services from Altruic Advisors. We’re here to help you create good!