Small donors have been making waves in the online fundraising world, from community GoFundMe campaigns to Facebook birthday fundraisers. This recent Classy article makes a strong case for the value of these small donations, especially from the perspective of donor engagement. But what about the administrative cost of tracking, recording, and reconciling all of those micro-donations? It’s true that every penny counts – but your time counts too! By setting up some smart systems and using technology to your advantage, you can reduce the administrative burden of small donations.

Opt For Electronic Payments

If you’ve ever seen the classic Seinfeld episode, “The Checks”, you know the struggle that comes with receiving a large number of very small checks. Fortunately, it’s not 1996 anymore and electronic deposits can save your check-signing hand from cramping up. Some popular third-party donation platforms, like Amazon Smile, don’t even give you the option of receiving paper checks – all donations are paid out via electronic funds transfers. But if you do have a choice, it’s always quicker and more efficient to opt for direct deposit to your organization’s bank account. With checks, you have to wait for it to travel through the mail, then take it to the bank and wait in line to deposit it to your account. With electronic payments, the funds are available in your account right away, without any extra work on your end.

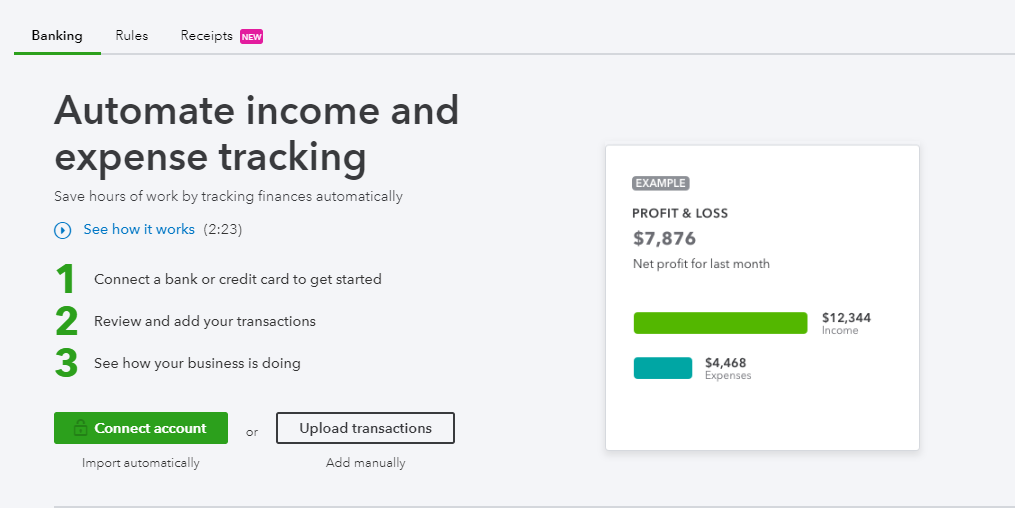

Connect Your Bank Accounts in QuickBooks Online

So you’re receiving electronic deposits instead of paper checks – great! Now how do you ensure those deposits are being recorded in your accounting system? If you use QuickBooks Online, it’s easy to connect your bank account so all transactions are automatically synced to QBO. From the QBO interface, simply choose your bank, sign in with your bank’s login information, and select an account to connect. After your banking history is downloaded to QBO, you can review and categorize each transaction. You can match items to existing records or add them as new records. You can also see at a glance which transactions have not been categorized yet, so you won’t miss even the smallest donation.

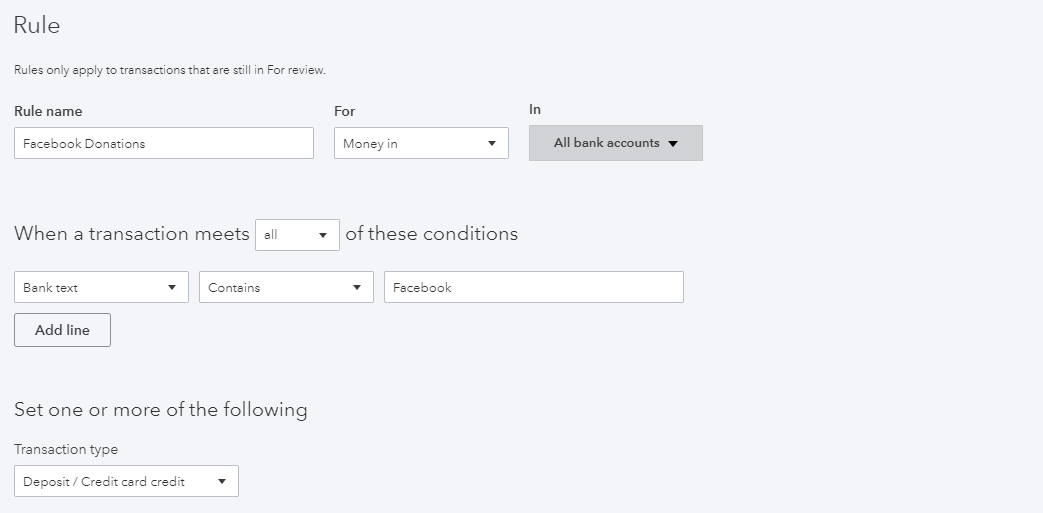

Create Rules for Recurring Donations

For frequent transactions, it can save a lot of time to set banking rules in QuickBooks Online. For example, if your nonprofit regularly receives deposits from peer-to-peer Facebook fundraisers, you can set a rule that automatically allocates those transactions to the correct revenue account. There’s no point in typing the same information over and over again when QBO’s “rules” function can do the work for you. (And don’t worry – you’ll still be able to review each transaction before it’s officially entered into your accounting record.)

Small donors can hold a lot of value for your organization, but it can be a struggle to justify the administrative burden of tracking and recording very small amounts. With the right systems in place, you can minimize the amount of time you’re spending on the accounting side – leaving more time to engage with your donors and grow support for your organization.